top of page

Chartered Accountant Firm

How to Register a Company in India: A Step-by-Step Guide (2026 Edition)

The Indian startup ecosystem is one of the most vibrant in the world. With the government’s focus on "Ease of Doing Business," the process of company registration has been streamlined into a single-window clearance system. Why Choose a Private Limited Company? Before diving into the "how," it is important to understand the "why." A Private Limited Company (Pvt. Ltd.) offers: • Limited Liability: Protects personal assets from business debts. • Separate Legal Entity: The comp

shubhamtulsian05

7 days ago2 min read

The Cost of Non-Compliance: A Guide to Income Tax Penalties in India (FY 2025-26)

One of the most common misconceptions among taxpayers is that paying tax late only attracts a small interest charge. While interest is certainly applicable, the Income Tax Act contains stringent penalty provisions—specifically for TDS defaults, concealment, and under-reporting—that can go as high as 200% or even 300% of the tax due. In this guide, we decode the critical sections of the Income Tax Act—271(1)(c), 271C, 234B/C, and 270A—to help you understand the true financial

shubhamtulsian05

Dec 13, 20253 min read

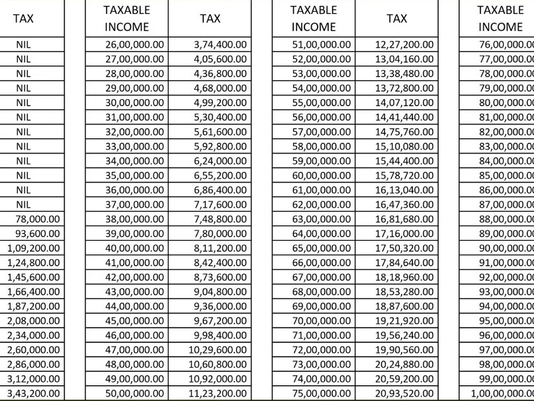

New Tax Regime 2025-26: How Much Tax Will You Actually Pay? (Tax Table Included)

Are you confused about how the latest budget changes affect your take-home pay? With the New Tax Regime now being the default choice , it is essential to understand exactly how much of your hard-earned money goes to the government. In this guide, we break down the tax liability for resident individuals for F.Y. 2025-26 with a comprehensive tax chart. The "Zero Tax" Threshold One of the most significant advantages of the New Tax Regime for the upcoming year is the increased l

shubhamtulsian05

Dec 13, 20252 min read

The Bridge to Excellence: Why Your CA Articleship is More Than a Requirement

For many CA students, the transition from clearing the Intermediate exams to starting Articleship feels like a rite of passage. It is the moment the "student" persona begins to evolve into a "professional." However, viewing Articleship as merely a mandatory three-year box to check is a missed opportunity. It is the most critical phase of your professional life—the bridge between theoretical knowledge and real-world mastery. Why Articleship is the Foundation of Your Career 1.

Pradeep Tulsian

Dec 12, 20252 min read

The Importance of Financial Advisory Services

In today’s complex economic environment, businesses face numerous challenges that require careful financial planning and strategic decision-making. Navigating these challenges without expert guidance can lead to missed opportunities and increased risks. This is where professional financial advisory services become indispensable. They provide the expertise and insight necessary to manage finances effectively, optimise investments, and ensure sustainable growth. Understanding F

shubhamtulsian05

Dec 11, 20254 min read

DECEMBER TAX COMPLIANCE DUE DATES

The Ultimate December 2025 Compliance Crunch: Monthly Due Dates + ANNUAL RETURNS! 🗓️🚨 Finance professionals and business owners, brace yourselves. December 2025 is not just about holiday cheer; it is arguably the heaviest compliance month of the year. Besides the usual monthly grind, we have critical Annual Return deadlines hitting this month. Missing these means substantial penalties and non-compliance flags as we head into 2026. Here is your master checklist to navigate t

Pradeep Tulsian

Dec 2, 20251 min read

Guide to Filing Income Tax in Ahmedabad

Filing income tax is a critical responsibility for businesses and individuals alike. It ensures compliance with government regulations and contributes to the nation’s development. Ahmedabad, a thriving commercial hub, presents unique opportunities and challenges in the tax filing process. This guide aims to provide a clear, structured approach to filing income tax in Ahmedabad, helping businesses navigate the complexities with confidence and precision. Understanding the Proce

shubhamtulsian05

Oct 31, 20254 min read

Expert Tax Planning Strategies for Businesses

Effective tax planning is a cornerstone of sound financial management for businesses of all sizes. It ensures compliance with tax laws...

shubhamtulsian05

Oct 13, 20254 min read

Tax Compliance Calendar: Key Due Dates for September 2025

September is a critical month for taxpayers and businesses in India, with several crucial deadlines for Income Tax, GST, and TDS...

Pradeep Tulsian

Sep 2, 20253 min read

Your Guide to August 2025 Tax Compliance: Key GST and TDS Deadlines

August is here, and with it comes a fresh set of compliance obligations for businesses in India. To help you navigate the month smoothly...

shubhamtulsian05

Aug 1, 20253 min read

bottom of page